Unemployment

Unemployment (or joblessness) occurs when people are without work and actively seeking work.[1] The unemployment rate is a measure of the prevalence of unemployment and it is calculated as a percentage by dividing the number of unemployed individuals by all individuals currently in the labor force. During periods of recession, an economy usually experiences a relatively high unemployment rate.[2] According to International Labour Organization report, more than 197 million people globally are out of work or 6% of the world's workforce were without a job in 2012.[3]

There remains considerable theoretical debate regarding the causes, consequences and solutions for unemployment. Classical economics, New classical economics, and the Austrian School of economics argue that market mechanisms are reliable means of resolving unemployment. These theories argue against interventions imposed on the labor market from the outside, such as unionization, bureaucratic work rules, minimum wage laws, taxes, and other regulations that they claim discourage the hiring of workers.

Keynesian economics emphasizes the cyclical nature of unemployment and recommends government interventions in the economy that it claims will reduce unemployment during recessions. This theory focuses on recurrent shocks that suddenly reduce aggregate demand for goods and services and thus reduce demand for workers. Keynesian models recommend government interventions designed to increase demand for workers; these can include financial stimuli, publicly funded job creation, and expansionist monetary policies. Keynes believed that the root cause of unemployment is the desire of investors to receive more money rather than produce more products, which is not possible without public bodies producing new money.[4]

In addition to these comprehensive theories of unemployment, there are a few categorizations of unemployment that are used to more precisely model the effects of unemployment within the economic system. The main types of unemployment include structural unemployment which focuses on structural problems in the economy and inefficiencies inherent in labour markets, including a mismatch between the supply and demand of laborers with necessary skill sets. Structural arguments emphasize causes and solutions related to disruptive technologies and globalization. Discussions of frictional unemployment focus on voluntary decisions to work based on each individuals' valuation of their own work and how that compares to current wage rates plus the time and effort required to find a job. Causes and solutions for frictional unemployment often address job entry threshold and wage rates. Behavioral economists highlight individual biases in decision making, and often involve problems and solutions concerning sticky wages andefficiency wages.

Definitions, types, and theories[edit]

Economists distinguish between various overlapping types of and theories of unemployment, including cyclical or Keynesian unemployment, frictional unemployment,structural unemployment and classical unemployment. Some additional types of unemployment that are occasionally mentioned are seasonal unemployment, hardcore unemployment, and hidden unemployment.

Though there have been several definitions of "voluntary" and "involuntary unemployment" in the economics literature, a simple distinction is often applied. Voluntary unemployment is attributed to the individual's decisions, whereas involuntary unemployment exists because of the socio-economic environment (including the market structure, government intervention, and the level of aggregate demand) in which individuals operate. In these terms, much or most of frictional unemployment is voluntary, since it reflects individual search behavior. Voluntary unemployment includes workers who reject low wage jobs whereas involuntary unemployment includes workers fired due to an economic crisis, industrial decline, company bankruptcy, or organizational restructuring.

On the other hand, cyclical unemployment, structural unemployment, and classical unemployment are largely involuntary in nature. However, the existence of structural unemployment may reflect choices made by the unemployed in the past, while classical (natural) unemployment may result from the legislative and economic choices made by labour unions or political parties. So, in practice, the distinction between voluntary and involuntary unemployment is hard to draw.

The involuntary unemployment are those where there are fewer job vacancies than unemployed workers even when wages are allowed to adjust, so that even if all vacancies were to be filled, some unemployed workers would still remain. This happens with cyclical unemployment

Classical unemployment[edit]

Classical or real-wage unemployment occurs when real wages for a job are set above the market-clearing level, causing the number of job-seekers to exceed the number of vacancies.

Many economists have argued that unemployment increases the more the government intervenes into the economy to try to improve the conditions of those without jobs.[citation needed] For example, minimum wage laws raise the cost of laborers with few skills to above the market equilibrium, resulting in people becoming unemployed who wish to work at the going rate but cannot as wage enforced is greater than their value as workers. Unemployment and Government in the Twentieth-Century America, economistsRichard Vedder and Lowell Gallaway argue that the empirical record of wages rates, productivity, and unemployment in American validates the classical unemployment theory. Their data shows a strong correlation between the adjusted real wage and unemployment in the United States from 1900 to 1990. However, they maintain that their data does not take into account exogenous events.[5]

Cyclical unemployment[edit]

Cyclical, deficient-demand, or Keynesian unemployment, occurs when there is not enough aggregate demand in the economy to provide jobs for everyone who wants to work. Demand for most goods and services falls, less production is needed and consequently fewer workers are needed, wages are sticky and do not fall to meet the equilibrium level, and mass unemployment results.[6] Its name is derived from the frequent shifts in the business cycle although unemployment can also be persistent as occurred during the Great Depression of the 1930s.

With cyclical unemployment, the number of unemployed workers exceeds the number of job vacancies, so that even if full employment were attained and all open jobs were filled, some workers would still remain unemployed. Some associate cyclical unemployment with frictional unemployment because the factors that cause the friction are partially caused by cyclical variables. For example, a surprise decrease in the money supply may shock rational economic factors and suddenly inhibit aggregate demand.

Keynesian economists on the other hand see the lack of demand for jobs as potentially resolvable by government intervention. One suggested interventions involves deficit spending to boost employment and demand. Another intervention involves an expansionarymonetary policy that increases the supply of money which should reduce interest rates which should lead to an increase in non-governmental spending.[7]

Marxian theory of unemployment[edit]

It is in the very nature of the capitalist mode of production to overwork some workers while keeping the rest as a reserve army of unemployed paupers.— Marx, Theory of Surplus Value, [8]

Marxists also share the Keynesian viewpoint of the relationship between economic demand and employment, but with the caveat that the market system's propensity to slash wages and reduce labor participation on an enterprise level causes a requisite decrease in aggregate demand in the economy as a whole, causing crises of unemployment and periods of low economic activity before the capital accumulation (investment) phase of economic growth can continue.

According to Karl Marx, unemployment is inherent within the unstable capitalist system and periodic crises of mass unemployment are to be expected. The function of theproletariat within the capitalist system is to provide a "reserve army of labour" that creates downward pressure on wages. This is accomplished by dividing the proletariat into surplus labour (employees) and under-employment (unemployed).[9] This reserve army of labour fight among themselves for scarce jobs at lower and lower wages.

At first glance, unemployment seems inefficient since unemployed workers do not increase profits. However, unemployment is profitable within the global capitalist system because unemployment lowers wages which are costs from the perspective of the owners. From this perspective low wages benefit the system by reducing economic rents. Yet, it does not benefit workers. Capitalist systems unfairly manipulate the market for labour by perpetuating unemployment which lowers laborers' demands for fair wages. Workers are pitted against one another at the service of increasing profits for owners.

According to Marx, the only way to permanently eliminate unemployment would be to abolish capitalism and the system of forced competition for wages and then shift to a socialist or communist economic system. For contemporary Marxists, the existence of persistent unemployment is proof of the inability of capitalism to ensure full employment.[10]

Full employment[edit]

Main article: Full employment

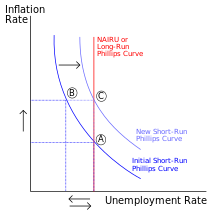

In demand-based theory, it is possible to abolish cyclical unemployment by increasing the aggregate demand for products and workers. However, eventually the economy hits an "inflation barrier" imposed by the four other kinds of unemployment to the extent that they exist. Historical experience suggests that low unemployment affects inflation in the short term but not the long term.[11] In the long term, thevelocity of money supply measures such as the MZM ("money zero maturity," representing cash and equivalent demand deposits) velocity is far more predictive of inflation than low unemployment.[12][13]

Some demand theory economists see the inflation barrier as corresponding to the natural rate of unemployment. The "natural" rate of unemployment is defined as the rate of unemployment that exists when the labour market is in equilibrium and there is pressure for neither rising inflation rates nor falling inflation rates. An alternative technical term for this rate is the NAIRU or the Non-Accelerating Inflation Rate of Unemployment. No matter what its name, demand theory holds that this means that if the unemployment rate gets "too low," inflation will accelerate in the absence of wage and price controls (incomes policies).

One of the major problems with the NAIRU theory is that no one knows exactly what the NAIRU is (while it clearly changes over time).[11]The margin of error can be quite high relative to the actual unemployment rate, making it hard to use the NAIRU in policy-making.[12]

Another, normative, definition of full employment might be called the ideal unemployment rate. It would exclude all types of unemployment that represent forms of inefficiency. This type of "full employment" unemployment would correspond to only frictional unemployment (excluding that part encouraging the McJobs management strategy) and would thus be very low. However, it would be impossible to attain this full-employment target using only demand-side Keynesian stimulus without getting below the NAIRU and causing accelerating inflation (absent incomes policies). Training programs aimed at fighting structural unemployment would help here.

To the extent that hidden unemployment exists, it implies that official unemployment statistics provide a poor guide to what unemployment rate coincides with "full employment".[11]

Structural unemployment[edit]

Main article: Structural unemployment

Structural unemployment occurs when a labour market is unable to provide jobs for everyone who wants one because there is a mismatch between the skills of the unemployed workers and the skills needed for the available jobs. Structural unemployment is hard to separate empirically from frictional unemployment, except to say that it lasts longer. As with frictional unemployment, simple demand-side stimulus will not work to easily abolish this type of unemployment.

Structural unemployment may also be encouraged to rise by persistent cyclical unemployment: if an economy suffers from long-lasting low aggregate demand, it means that many of the unemployed become disheartened, while their skills (including job-searching skills) become "rusty" and obsolete. Problems with debt may lead to homelessness and a fall into the vicious circle of poverty.

This means that they may not fit the job vacancies that are created when the economy recovers. The implication is that sustained highdemand may lower structural unemployment. This theory of persistence in structural unemployment has been referred to as an example ofpath dependence or "hysteresis".

Much technological unemployment,[14] due to the replacement of workers by machines, might be counted as structural unemployment. Alternatively, technological unemployment might refer to the way in which steady increases in labour productivity mean that fewer workers are needed to produce the same level of output every year. The fact that aggregate demand can be raised to deal with this problem suggests that this problem is instead one of cyclical unemployment. As indicated by Okun's Law, the demand side must grow sufficiently quickly to absorb not only the growing labour force but also the workers made redundant by increased labour productivity.

Seasonal unemployment may be seen as a kind of structural unemployment, since it is a type of unemployment that is linked to certain kinds of jobs (construction work, migratory farm work). The most-cited official unemployment measures erase this kind of unemployment from the statistics using "seasonal adjustment" techniques. The resulting in substantial, permanent structural unemployment.

Frictional unemployment[edit]

Main article: Frictional unemployment

Frictional unemployment is the time period between jobs when a worker is searching for, or transitioning from one job to another. It is sometimes called search unemployment and can be voluntary based on the circumstances of the unemployed individual. Frictional unemployment is always present in an economy, so the level of involuntary unemployment is properly the unemployment rate minus the rate of frictional unemployment, which means that increases or decreases in unemployment are normally under-represented in the simple statistics.[15]

Frictional unemployment exists because both jobs and workers are heterogeneous, and a mismatch can result between the characteristics of supply and demand. Such a mismatch can be related to skills, payment, work-time, location, seasonal industries, attitude, taste, and a multitude of other factors. New entrants (such as graduating students) and re-entrants (such as former homemakers) can also suffer a spell of frictional unemployment.

Workers as well as employers accept a certain level of imperfection, risk or compromise, but usually not right away; they will invest some time and effort to find a better match. This is in fact beneficial to the economy since it results in a better allocation of resources. However, if the search takes too long and mismatches are too frequent, the economy suffers, since some work will not get done. Therefore, governments will seek ways to reduce unnecessary frictional unemployment through multiple means including providing education, advice, training, and assistance such asdaycare centers.

The frictions in the labour market are sometimes illustrated graphically with a Beveridge curve, a downward-sloping, convex curve that shows a correlation between the unemployment rate on one axis and the vacancy rate on the other. Changes in the supply of or demand for labour cause movements along this curve. An increase (decrease) in labour market frictions will shift the curve outwards (inwards).

Hidden unemployment[edit]

Hidden, or covered, unemployment is the unemployment of potential workers that is not reflected in official unemployment statistics, due to the way the statistics are collected. In many countries only those who have no work but are actively looking for work (and/or qualifying for social security benefits) are counted as unemployed. Those who have given up looking for work (and sometimes those who are on Government "retraining" programs) are not officially counted among the unemployed, even though they are not employed. The exception is in places like Australia where the real IDU (International Definition of Unemployment) rate is approx 28%[citation needed] and the declared rate is approx 4%. In this instance the actual definition of unemployment was altered in 1974 to ignore 1) anyone who had a wife who worked 2) anyone who had money in the bank and 3) anyone who worked more than 2 hours a week in part-time work. The ACTU measured Australian jobs in 2010 and observed that 40% of jobs Australia wide were casual or part-time. One could observe that the Australian economy is actually a basket case and the distorted IDU rate has the population oblivious to the economic calamity that is not recorded in the absence of work.[dubious ] To back up this observation the ASIC figures[citation needed] show that the average Australian business employs 0.9 (zero point nine) people whereas the average in the UK is 45. To say the real figures have been hidden is an understatement. The same applies to those who have taken early retirement to avoid being laid off, but would prefer to be working. As well, persons on disability benefits do not count as unemployed.[16]

The statistic also does not count the "underemployed" – those working fewer hours than they would prefer or in a job that doesn't make good use of their capabilities. In addition, those who are of working age but are currently in full-time education are usually not considered unemployed in government statistics. Traditional unemployed native societies who survive by gathering, hunting, herding, and farming in wilderness areas, may or may not be counted in unemployment statistics. Official statistics often underestimate unemployment rates because of hidden unemployment.

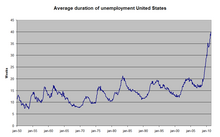

Long-term unemployment[edit]

This is normally defined, for instance in European Union statistics, as unemployment lasting for longer than one year. It is an important indicator of social exclusion. The United States Bureau of Labor Statistics (BLS) reports this as 27 weeks or longer. Long-term unemployment can result in older workers taking early retirement; in the United States, taking reduced social security benefits at age 62.[17]

Measurement[edit]

There are also different ways national statistical agencies measure unemployment. These differences may limit the validity of international comparisons of unemployment data.[18] To some degree these differences remain despite national statistical agencies increasingly adopting the definition of unemployment by the International Labour Organization.[19] To facilitate international comparisons, some organizations, such as the OECD, Eurostat, and International Labor Comparisons Program, adjust data on unemployment for comparability across countries.

Though many people care about the number of unemployed individuals, economists typically focus on the unemployment rate. This corrects for the normal increase in the number of people employed due to increases in population and increases in the labour force relative to the population. The unemployment rate is expressed as a percentage, and is calculated as follows:

As defined by the International Labour Organization, "unemployed workers" are those who are currently not working but are willing and able to work for pay, currently available to work, and have actively searched for work.[20] Individuals who are actively seeking job placement must make the effort to: be in contact with an employer, have job interviews, contact job placement agencies, send out resumes, submit applications, respond to advertisements, or some other means of active job searching within the prior four weeks. Simply looking at advertisements and not responding will not count as actively seeking job placement. Since not all unemployment may be "open" and counted by government agencies, official statistics on unemployment may not be accurate.[21] In the United States, for example, the unemployment rate does not take into consideration those individuals who are not actively looking for employment, such as those still attending college.[22]

- Labour Force Sample Surveys are the most preferred method of unemployment rate calculation since they give the most comprehensive results and enables calculation of unemployment by different group categories such as race and gender. This method is the most internationally comparable.

- Official Estimates are determined by a combination of information from one or more of the other three methods. The use of this method has been declining in favor of Labour Surveys.

- Social Insurance Statistics such as unemployment benefits, are computed base on the number of persons insured representing the total labour force and the number of persons who are insured that are collecting benefits. This method has been heavily criticized due to the expiration of benefits before the person finds work.

- Employment Office Statistics are the least effective being that they only include a monthly tally of unemployed persons who enter employment offices. This method also includes unemployed who are not unemployed per the ILO definition.

The primary measure of unemployment, U3, allows for comparisons between countries. Unemployment differs from country to country and across different time periods. For example, during the 1990s and 2000s, the United States had lower unemployment levels than many countries in the European Union,[24] which had significant internal variation, with countries like the UK and Denmark outperforming Italy and France. However, large economic events such as the Great Depression can lead to similar unemployment rates across the globe.

European Union (Eurostat)[edit]

Further information: List of sovereign states in Europe by unemployment rate

Eurostat, the statistical office of the European Union, defines unemployed as those persons age 15 to 74 who are not working, have looked for work in the last four weeks, and ready to start work within two weeks, which conform to ILO standards. Both the actual count and rate of unemployment are reported. Statistical data are available by member state, for the European Union as a whole (EU27) as well as for the euro area (EA16). Eurostat also includes a long-term unemployment rate. This is defined as part of the unemployed who have been unemployed for an excess of 1 year.[25]

The main source used is the European Union Labour Force Survey (EU-LFS). The EU-LFS collects data on all member states each quarter. For monthly calculations, national surveys or national registers from employment offices are used in conjunction with quarterly EU-LFS data. The exact calculation for individual countries, resulting in harmonized monthly data, depend on the availability of the data.[26]

United States Bureau of Labor statistics[edit]

See also: Unemployment in the United States

The Bureau of Labor Statistics measures employment and unemployment (of those over 15 years of age) using two different labour force surveys[28] conducted by the United States Census Bureau (within the United States Department of Commerce) and/or the Bureau of Labor Statistics (within the United States Department of Labor) that gather employment statistics monthly. The Current Population Survey(CPS), or "Household Survey", conducts a survey based on a sample of 60,000 households. This Survey measures the unemployment rate based on the ILO definition.[29]

The Current Employment Statistics survey (CES), or "Payroll Survey", conducts a survey based on a sample of 160,000 businesses and government agencies that represent 400,000 individual employers.[30] This survey measures only civilian nonagricultural employment; thus, it does not calculate an unemployment rate, and it differs from the ILO unemployment rate definition. These two sources have different classification criteria, and usually produce differing results. Additional data are also available from the government, such as the unemployment insurance weekly claims report available from the Office of Workforce Security, within the U.S. Department of Labor Employment & Training Administration.[31] The Bureau of Labor Statistics provides up-to-date numbers via a PDF linked here.[32] The BLS also provides a readable concise current Employment Situation Summary, updated monthly.[33]

The Bureau of Labor Statistics also calculates six alternate measures of unemployment, U1 through U6, that measure different aspects of unemployment:[34]

- U1:[35] Percentage of labor force unemployed 15 weeks or longer.

- U2: Percentage of labor force who lost jobs or completed temporary work.

- U3: Official unemployment rate per the ILO definition occurs when people are without jobs and they have actively looked for workwithin the past four weeks.[1]

- U4: U3 + "discouraged workers", or those who have stopped looking for work because current economic conditions make them believe that no work is available for them.

- U5: U4 + other "marginally attached workers", or "loosely attached workers", or those who "would like" and are able to work, but have not looked for work recently.

- U6: U5 + Part-time workers who want to work full-time, but cannot due to economic reasons (underemployment).

Note: "Marginally attached workers" are added to the total labour force for unemployment rate calculation for U4, U5, and U6. The BLS revised the CPS in 1994 and among the changes the measure representing the official unemployment rate was renamed U3 instead of U5.[36] In 2013, Representative Hunter proposed that the Bureau of Labor Statistics use the U5 rate instead of the current U3 rate.[37]

Statistics for the U.S. economy as a whole hide variations among groups. For example, in January 2008 U.S. unemployment rates were 4.4% for adult men, 4.2% for adult women, 4.4% for Caucasians, 6.3% for Hispanics or Latinos (all races), 9.2% for African Americans, 3.2% for Asian Americans, and 18.0% for teenagers.[30] Also, the U.S. unemployment rate would be at least 2% higher if prisoners and jail inmates were counted.[38][39]

The unemployment rate is included in a number of major economic indexes including the United States' Conference Board's Index of Leading Indicators a macroeconomic measure of the state of the economy.

Alternatives[edit]

Limitations of the unemployment definition[edit]

Some critics believe that current methods of measuring unemployment are inaccurate in terms of the impact of unemployment on people as these methods do not take into account the 1.5% of the available working population incarcerated in U.S. prisons (who may or may not be working while incarcerated), those who have lost their jobs and have become discouraged over time from actively looking for work, those who are self-employed or wish to become self-employed, such as tradesmen or building contractors or IT consultants, those who have retired before the official retirement age but would still like to work (involuntary early retirees), those on disability pensions who, while not possessing full health, still wish to work in occupations suitable for their medical conditions, those who work for payment for as little as one-hour per week but would like to work full-time.[45]

These people are "involuntary part-time" workers, those who are underemployed, e.g., a computer programmer who is working in a retail store until he can find a permanent job, involuntary stay-at-home mothers who would prefer to work, and graduate and Professional school students who were unable to find worthwhile jobs after they graduated with their Bachelor's degrees.

Internationally, some nations' unemployment rates are sometimes muted or appear less severe due to the number of self-employed individuals working in agriculture.[40] Small independent farmers are often considered self-employed; so, they cannot be unemployed. The impact of this is that in non-industrialized economies, such as the United States and Europe during the early 19th century, overall unemployment was approximately 3% because so many individuals were self-employed, independent farmers; yet, unemployment outside of agriculture was as high as 80%.[40]

Many economies industrialize and experience increasing numbers of non-agricultural workers. For example, the United States' non-agricultural labour force increased from 20% in 1800, to 50% in 1850, to 97% in 2000.[40] The shift away from self-employment increases the percentage of the population who are included in unemployment rates. When comparing unemployment rates between countries or time periods, it is best to consider differences in their levels of industrialization and self-employment.

Additionally, the measures of employment and unemployment may be "too high". In some countries, the availability of unemployment benefits can inflate statistics since they give an incentive to register as unemployed. People who do not really seek work may choose to declare themselves unemployed so as to get benefits; people with undeclared paid occupations may try to get unemployment benefits in addition to the money they earn from their work.[46]

However, in countries such as the United States, Canada, Mexico, Australia, Japan and the European Union, unemployment is measured using a sample survey (akin to a Gallup poll).[19] According to the BLS, a number of Eastern European nations have instituted labour force surveys as well. The sample survey has its own problems because the total number of workers in the economy is calculated based on a sample rather than a census.

It is possible to be neither employed nor unemployed by ILO definitions, i.e., to be outside of the "labour force."[21] These are people who have no job and are not looking for one. Many of these are going to school or are retired. Family responsibilities keep others out of the labour force. Still others have a physical or mental disability which prevents them from participating in labour force activities. And of course some people simply elect not to work, preferring to be dependent on others for sustenance.

Typically, employment and the labour force include only work done for monetary gain. Hence, a homemaker is neither part of the labour force nor unemployed. Nor are full-time students nor prisoners considered to be part of the labour force or unemployment.[45] The latter can be important. In 1999, economists Lawrence F. Katz and Alan B. Krueger estimated that increased incarceration lowered measured unemployment in the United States by 0.17% between 1985 and the late 1990s.[45]

In particular, as of 2005, roughly 0.7% of the U.S. population is incarcerated (1.5% of the available working population). Additionally, children, the elderly, and some individuals with disabilities are typically not counted as part of the labour force in and are correspondingly not included in the unemployment statistics. However, some elderly and many disabled individuals are active in the labour market

In the early stages of an economic boom, unemployment often rises.[6] This is because people join the labour market (give up studying, start a job hunt, etc.) because of the improving job market, but until they have actually found a position they are counted as unemployed. Similarly, during a recession, the increase in the unemployment rate is moderated by people leaving the labour force or being otherwise discounted from the labour force, such as with the self-employed.

For the fourth quarter of 2004, according to OECD, (source Employment Outlook 2005 ISBN 92-64-01045-9), normalized unemployment for men aged 25 to 54 was 4.6% in the U.S. and 7.4% in France. At the same time and for the same population the employment rate (number of workers divided by population) was 86.3% in the U.S. and 86.7% in France. This example shows that the unemployment rate is 60% higher in France than in the U.S., yet more people in this demographic are working in France than in the U.S., which is counterintuitive if it is expected that the unemployment rate reflects the health of the labour market.[47][48]

Due to these deficiencies, many labour market economists prefer to look at a range of economic statistics such as labour market participation rate, the percentage of people aged between 15 and 64 who are currently employed or searching for employment, the total number of full-time jobs in an economy, the number of people seeking work as a raw number and not a percentage, and the total number of person-hours worked in a month compared to the total number of person-hours people would like to work. In particular theNBER does not use the unemployment rate but prefer various employment rates to date recessions.[49]

Labor force participation rate[edit]

The labor force participation rate is the ratio between the labor force and the overall size of their cohort (national population of the same age range). In the West during the later half of the 20th century, the labor force participation rate increased significantly, largely due to the increasing number of women entering the workplace.

In the United States, there were three significant stages of women's increased participation in the labor force. During the late 19th century through the 1920s, very few women worked. They were young single women who typically withdrew from labor force at marriage unless family needed two incomes. These women worked primarily in the textile manufacturing industry or as domestic workers. This profession empowered women and allowed them to earn a living wage. At times, they were a financial help to their families.

Between 1930 and 1950, women labor force participation has increased primarily due to the increased demand for office workers, women participation in the high school movement, and due to electrification which reduced the time spent on household chores. In the 1950s to the 1970s, most women were secondary earners working mainly as secretaries, teachers, nurses, and librarians (pink-collar jobs).

Claudia Goldin and others, specifically point that by the mid-1970s there was a period of revolution of women in the labor force brought on by a source of different factors. Women more accurately planned for their future in the work force, investing in more applicable majors in college that prepared them to enter and compete in the labor market. In the United States, the labor force participation rate rose from approximately 59% in 1948 to 66% in 2005,[50] with participation among women rising from 32% to 59%[51] and participation among men declining from 87% to 73%.[52][53]

A common theory in modern economics claims that the rise of women participating in the U.S. labor force in the late 1960s was due to the introduction of a new contraceptive technology, birth control pills, and the adjustment of age of majority laws. The use of birth control gave women the flexibility of opting to invest and advance their career while maintaining a relationship. By having control over the timing of their fertility, they were not running a risk of thwarting their career choices. However, only 40% of the population actually used the birth control pill.

This implies that other factors may have contributed to women choosing to invest in advancing their careers. One factor may be that more and more men delayed the age of marriage, allowing women to marry later in life without worrying about the quality of older men. Other factors include the changing nature of work, with machines replacing physical labor, eliminating many traditional male occupations, and the rise of the service sector, where many jobs are gender neutral.

Another factor that may have contributed to the trend was The Equal Pay Act of 1963, which aimed at abolishing wage disparity based on sex. Such legislation diminished sexual discrimination and encouraged more women to enter the labor market by receiving fair remuneration to help raising families and children.

At the turn of the 21st century the labor force participation began to reverse its long period of increase. The biggest drop occurring over the period from 2007 to 2011 where participation declined from 66% to 64.1%. Roughly half of this decline can be attributed to cyclical factors and half to long-term trend factors. These long-term trend factors include a rising share of older workers and an increase in school enrollment rates among young workers.[54]

The labor force participation rate can decrease when the rate of growth of the population outweighs that of the employed and unemployed together. The labor force participation rate is a key component in long-term economic growth, almost as important as productivity.

Participation rates are defined as follows:

| Pop = total population | LF = labor force = U + E |

| LFpop = labor force population (generally defined as all men and women aged 15–64) | p = participation rate = LF / LFpop |

| E = number employed | e = rate of employment = E / LF |

| U = number of unemployed | u = rate of unemployment = U / LF |

The labor force participation rate explains how an increase in the unemployment rate can occur simultaneously with an increase in employment. If a large amount of new workers enter the labor force but only a small fraction become employed, then the increase in the number of unemployed workers can outpace the growth in employment.[55]

Unemployment ratio[edit]

The unemployment ratio calculates the share of unemployed for the whole population. Particularly many young people between 15 and 24 are studying full-time and are therefore neither working nor looking for a job. This means they are not part of the labour force which is used as the denominator for calculating the unemployment rate.[56] The youth unemployment ratios in the European Union range from 5.2 (Austria) to 20.6 percent (Spain). These are considerably lower than the standard youth unemployment rates, ranging from 7.9 (Germany) to 57.9 percent (Greece).[57]

Effects[edit]

High and persistent unemployment, in which economic inequality increases, has a negative effect on subsequent long-run economic growth. Unemployment can harm growth not only because it is a waste of resources, but also because it generates redistributive pressures and subsequent distortions, drives people to poverty, constrains liquidity limiting labor mobility, and erodes self-esteem promoting social dislocation, unrest and conflict.[58] 2013 Economics Nobel prize winner Robert J. Shiller said that rising inequality in the United States and elsewhere is the most important problem.[59]

Costs[edit]

Individual[edit]

Unemployed individuals are unable to earn money to meet financial obligations. Failure to pay mortgage payments or to pay rent may lead to homelessness through foreclosure or eviction.[60] Across the United States the growing ranks of people made homeless in the foreclosure crisis are generating tent cities.[61]

Unemployment increases susceptibility to malnutrition, illness, mental stress, and loss of self-esteem, leading to depression. According to a study published in Social Indicator Research, even those who tend to be optimistic find it difficult to look on the bright side of things when unemployed. Using interviews and data from German participants aged 16 to 94 – including individuals coping with the stresses of real life and not just a volunteering student population – the researchers determined that even optimists struggled with being unemployed.[62]

In 1979, Brenner found that for every 10% increase in the number of unemployed there is an increase of 1.2% in total mortality, a 1.7% increase in cardiovascular disease, 1.3% more cirrhosis cases, 1.7% more suicides, 4.0% more arrests, and 0.8% more assaults reported to the police.[63][64]

A study by Ruhm, in 2000, on the effect of recessions on health found that several measures of health actually improve during recessions.[65] As for the impact of an economic downturn on crime, during the Great Depression the crime rate did not decrease. The unemployed in the U.S. often use welfare programs such as Food Stamps or accumulating debt because unemployment insurance in the U.S. generally does not replace a majority of the income one received on the job (and one cannot receive such aid indefinitely).

Not everyone suffers equally from unemployment. In a prospective study of 9570 individuals over four years, highly conscientious people suffered more than twice as much if they became unemployed.[66] The authors suggested this may be due to conscientious people making different attributions about why they became unemployed, or through experiencing stronger reactions following failure. There is also possibility of reverse causality from poor health to unemployment.[67]

Some[who?] hold that many of the low-income jobs are not really a better option than unemployment with a welfare state (with its unemployment insurance benefits). But since it is difficult or impossible to get unemployment insurance benefits without having worked in the past, these jobs and unemployment are more complementary than they are substitutes. (These jobs are often held short-term, either by students or by those trying to gain experience; turnover in most low-paying jobs is high.)

Another cost for the unemployed is that the combination of unemployment, lack of financial resources, and social responsibilities may push unemployed workers to take jobs that do not fit their skills or allow them to use their talents. Unemployment can cause underemployment, and fear of job loss can spur psychological anxiety. As well as anxiety, it can cause depression, lack of confidence, and huge amounts of stress. They will begin to lose social contacts, and good social skills.

Social[edit]

An economy with high unemployment is not using all of the resources, specifically labour, available to it. Since it is operating below itsproduction possibility frontier, it could have higher output if all the workforce were usefully employed. However, there is a trade-off between economic efficiency and unemployment: if the frictionally unemployed accepted the first job they were offered, they would be likely to be operating at below their skill level, reducing the economy's efficiency.[68]

During a long period of unemployment, workers can lose their skills, causing a loss of human capital. Being unemployed can also reduce the life expectancy of workers by about seven years.[69]

High unemployment can encourage xenophobia and protectionism as workers fear that foreigners are stealing their jobs.[70] Efforts to preserve existing jobs of domestic and native workers include legal barriers against "outsiders" who want jobs, obstacles to immigration, and/or tariffs and similar trade barriers against foreign competitors.

High unemployment can also cause social problems such as crime; if people have less disposable income than before, it is very likely that crime levels within the economy will increase.

Socio-political[edit]

High levels of unemployment can be causes of civil unrest, in some cases leading to revolution, and particularly totalitarianism. The fall of the Weimar Republic in 1933 and Adolf Hitler's rise to power, which culminated in World War II and the deaths of tens of millions and the destruction of much of the physical capital of Europe, is attributed to the poor economic conditions in Germany at the time, notably a high unemployment rate[71] of above 20%; see Great Depression in Central Europe for details.

Note that the hyperinflation in the Weimar Republic is not directly blamed for the Nazi rise – the Inflation in the Weimar Republic occurred primarily in the period 1921–23, which was contemporary with Hitler's Beer Hall Putsch of 1923, and is blamed for damaging the credibility of democratic institutions, but the Nazis did not assume government until 1933, ten years after the hyperinflation but in the midst of high unemployment.

Rising unemployment has traditionally been regarded by the public and media in any country as a key guarantor of electoral defeat for any government which oversees it. This was very much the consensus in the United Kingdom until 1983, when Margaret Thatcher'sConservative government won a landslide in the general election, despite overseeing a rise in unemployment from 1,500,000 to 3,200,000 since its election four years earlier.[72]

Benefits[edit]

Main article: Full employment

The primary benefit of unemployment is that people are available for hire, without being headhunted away from their existing employers. This permits new and old businesses to take on staff.

Unemployment is argued to be "beneficial" to the people who are not unemployed in the sense that it averts inflation,[citation needed] which itself has damaging effects, by providing (in Marxian terms) a reserve army of labour, that keeps wages in check. However the direct connection between full local employment and local inflation has been disputed by some due to the recent increase in international trade that supplies low-priced goods even while local employment rates rise to full employment.[73]

Full employment cannot be achieved because workers would shirk[citation needed] if they were not threatened with the possibility of unemployment. The curve for the no-shirking condition (labeled NSC) goes to infinity at full employment as a result. The inflation-fighting benefits to the entire economy arising from a presumed optimum level of unemployment has been studied extensively.[74] The Shapiro–Stiglitz model suggests that wages are not bid down sufficiently to ever reach 0% unemployment.[75] This occurs because employers know that when wages decrease, workers will shirk and expend less effort. Employers avoid shirking by preventing wages from decreasing so low that workers give up and become unproductive. These higher wages perpetuate unemployment while the threat of unemployment reduces shirking.

Before current levels of world trade were developed, unemployment was demonstrated to reduce inflation, following the Phillips curve, or to decelerate inflation, following the NAIRU/natural rate of unemployment theory, since it is relatively easy to seek a new job without losing one's current one. And when more jobs are available for fewer workers (lower unemployment), it may allow workers to find the jobs that better fit their tastes, talents, and needs.

As in the Marxian theory of unemployment, special interests may also benefit: some employers may expect that employees with no fear of losing their jobs will not work as hard, or will demand increased wages and benefit. According to this theory, unemployment may promote general labour productivity and profitability by increasing employers' rationale for their monopsony-like power (and profits).[8]

Optimal unemployment has also been defended as an environmental tool to brake the constantly accelerated growth of the GDP to maintain levels sustainable in the context of resource constraints and environmental impacts.[76] However the tool of denying jobs to willing workers seems a blunt instrument for conserving resources and the environment – it reduces the consumption of the unemployed across the board, and only in the short term. Full employment of the unemployed workforce, all focused toward the goal of developing more environmentally efficient methods for production and consumption might provide a more significant and lasting cumulative environmental benefit and reduced resource consumption.[77] If so the future economy and workforce would benefit from the resultant structural increases in the sustainable level of GDP growth.

Some critics of the "culture of work" such as anarchist Bob Black see employment as overemphasized culturally in modern countries. Such critics often propose quitting jobs when possible, working less, reassessing the cost of living to this end, creation of jobs which are "fun" as opposed to "work," and creating cultural norms where work is seen as unhealthy. These people advocate an "anti-work" ethic for life.[78]

Decline in work hours[edit]

As a result of productivity the work week declined considerably over the 19th century.[79][80] By the 1920s in the U.S. the average work week was 49 hours, but the work week was reduced to 40 hours (after which overtime premium was applied) as part of the National Industrial Recovery Act of 1933. At the time of the Great Depression of the 1930s it was understood that with the enormous productivity gains due to electrification, mass production and agricultural mechanization, there was no need for a large number of previously employed workers.[14][81]

Controlling or reducing unemployment[edit]

| 1936 | 1937 | 1938 | 1939 | 1940 | 1941 | |

|---|---|---|---|---|---|---|

| Workers employed | ||||||

| WPA | 1,995 | 2,227 | 1,932 | 2,911 | 1,971 | 1,638 |

| CCC and NYA | 712 | 801 | 643 | 793 | 877 | 919 |

| Other federal work projects | 554 | 663 | 452 | 488 | 468 | 681 |

| Cases on public assistance | ||||||

| Social security programs | 602 | 1,306 | 1,852 | 2,132 | 2,308 | 2,517 |

| General relief | 2,946 | 1,484 | 1,611 | 1,647 | 1,570 | 1,206 |

| Totals | ||||||

| Total families helped | 5,886 | 5,660 | 5,474 | 6,751 | 5,860 | 5,167 |

| Unemployed workers (BLS) | 9,030 | 7,700 | 10,390 | 9,480 | 8,120 | 5,560 |

| Coverage (cases/unemployed) | 65% | 74% | 53% | 71% | 72% | 93% |

Societies try a number of different measures to get as many people as possible into work, and various societies have experienced close to full employment for extended periods, particularly during the Post-World War II economic expansion. The United Kingdom in the 1950s and 60s averaged 1.6% unemployment,[83] while in Australia the 1945White Paper on Full Employment in Australia established a government policy of full employment, which policy lasted until the 1970s when the government ran out of money.

However, mainstream economic discussions of full employment since the 1970s suggest that attempts to reduce the level of unemployment below the natural rate of unemployment will fail, resulting only in less output and more inflation.

Demand-side solutions[edit]

Many countries aid the unemployed through social welfare programs. These unemployment benefits includeunemployment insurance, unemployment compensation, welfare and subsidies to aid in retraining. The main goal of these programs is to alleviate short-term hardships and, more importantly, to allow workers more time to search for a job.

A direct demand-side solution to unemployment is government-funded employment of the able-bodied poor. This was notably implemented in Britain from the 17th century until 1948 in the institution of the workhouse, which provided jobs for the unemployed with harsh conditions and poor wages to dissuade their use. A modern alternative is a job guarantee, where the government guarantees work at a living wage.

Temporary measures can include public works programs such as the Works Progress Administration. Government-funded employment is not widely advocated as a solution to unemployment, except in times of crisis; this is attributed to the public sector jobs' existence depending directly on the tax receipts from private sector employment.

In the U.S., the unemployment insurance allowance one receives is based solely on previous income (not time worked, family size, etc.) and usually compensates for one-third of one's previous income. To qualify, one must reside in their respective state for at least a year and, of course, work. The system was established by the Social Security Act of 1935. Although 90% of citizens are covered by unemployment insurance, less than 40% apply for and receive benefits.[84] However, the number applying for and receiving benefits increases during recessions. In cases of highly seasonal industries the system provides income to workers during the off seasons, thus encouraging them to stay attached to the industry.

According to classical economic theory, markets reach equilibrium where supply equals demand; everyone who wants to sell at the market price can. Those who do not want to sell at this price do not; in the labour market this is classical unemployment. Increases in the demand for labour will move the economy along the demand curve, increasing wages and employment. The demand for labour in an economy is derived from the demand for goods and services. As such, if the demand for goods and services in the economy increases, the demand for labour will increase, increasing employment and wages.

Monetary policy and fiscal policy can both be used to increase short-term growth in the economy, increasing the demand for labour and decreasing unemployment.

Supply-side solutions[edit]

However, the labour market is not 100% efficient: It does not clear, though it may be more efficient than bureaucracy. Some argue that minimum wages and union activity keep wages from falling, which means too many people want to sell their labour at the going price but cannot. This assumes perfect competition exists in the labour market, specifically that no single entity is large enough to affect wage levels.

Advocates of supply-side policies believe those policies can solve this by making the labour market more flexible. These include removing the minimum wage and reducing the power of unions. Supply-siders argue the reforms increase long-term growth. This increased supply of goods and services requires more workers, increasing employment. It is argued that supply-side policies, which include cutting taxes on businesses and reducing regulation, create jobs and reduce unemployment. Other supply-side policies include education to make workers more attractive to employers.

History[edit]

There are relatively limited historical records on unemployment because it has not always been acknowledged or measured systematically. Industrialization involves economies of scale that often prevent individuals from having the capital to create their own jobs to be self-employed. An individual who cannot either join an enterprise or create a job is unemployed. As individual farmers, ranchers, spinners, doctors and merchants are organized into large enterprises, those who cannot join or compete become unemployed.

Recognition of unemployment occurred slowly as economies across the world industrialized and bureaucratized. Before this, traditional self sufficient native societies have no concept of unemployment. The recognition of the concept of "unemployment" is best exemplified through the well documented historical records in England. For example, in 16th century England no distinction was made between vagrants and the jobless; both were simply categorized as "sturdy beggars", to be punished and moved on.[86]

The closing of the monasteries in the 1530s increased poverty, as the church had helped the poor. In addition, there was a significant rise in enclosure during the Tudor period. Also the population was rising. Those unable to find work had a stark choice: starve or break the law. In 1535, a bill was drawn up calling for the creation of a system of public works to deal with the problem of unemployment, to be funded by a tax on income and capital. A law passed a year later allowed vagabonds to be whipped and hanged.[87]

In 1547, a bill was passed that subjected vagrants to some of the more extreme provisions of the criminal law, namely two years servitude and branding with a "V" as the penalty for the first offense and death for the second.[88] During the reign of Henry VIII, as many as 72,000 people are estimated to have been executed.[89] In the 1576 Act each town was required to provide work for the unemployed.[90]

The Elizabethan Poor Law of 1601, one of the world's first government-sponsored welfare programs, made a clear distinction between those who were unable to work and those able-bodied people who refused employment.[91] Under the Poor Law systems of England and Wales, Scotland and Ireland a workhouse was a place where people who were unable to support themselves, could go to live and work.[92]

Industrial Revolution to late 19th century[edit]

Poverty was a highly visible problem in the eighteenth century, both in cities and in the countryside. In France and Britain by the end of the century, an estimated 10 percent of the people depended on charity or begging for their food.—Jackson J. Spielvogel (2008), Cengage Learning. p.566. ISBN 0-495-50287-1

By 1776 some 1,912 parish and corporation workhouses had been established in England and Wales, housing almost 100,000 paupers.

A description of the miserable living standards of the mill workers in England in 1844 was given by Fredrick Engels in The Condition of the Working-Class in England in 1844.[93] In the preface to the 1892 edition Engels notes that the extreme poverty he wrote about in 1844 had largely disappeared. David Ames Wells also noted that living conditions in England had improved near the end of the 19th century and that unemployment was low.

The scarcity and high price of labor in the U.S. during the 19th century was well documented by contemporary accounts, as in the following:

"The laboring classes are comparatively few in number, but this is counterbalanced by, and indeed, may be one of the causes of the eagerness by which they call in the use of machinery in almost every department of industry. Wherever it can be applied as a substitute for manual labor, it is universally and willingly resorted to ....It is this condition of the labor market, and this eager resort to machinery wherever it can be applied, to which, under the guidance of superior education and intelligence, the remarkable prosperity of the United States is due."[94] Joseph Whitworth, 1854

Scarcity of labor was a factor in the economics of slavery in the U.S.

As new territories were opened and Federal land sales conducted, land had to be cleared and new homesteads established. Hundreds of thousands of immigrants annually came to the U.S. and found jobs digging canals and building railroads. Almost all work during most of the 19th century was done by hand or with horses, mules, or oxen, because there was very little mechanization. The workweek during most of the 19th century was 60 hours. Unemployment at times was between one and two percent.

The tight labor market was a factor in productivity gains allowing workers to maintain or increase their nominal wages during the secular deflation that caused real wages to rise at various times in the 19th century, especially in the final decades.[95]

20th century[edit]

There were labor shortages during WW I.[14] Ford Motor Co. doubled wages to reduce turnover. After 1925 unemployment began to gradually rise.[96]

Great Depression[edit]

The decade of the 1930s saw the Great Depression impact unemployment across the globe. One Soviet trading corporation in New York averaged 350 applications a day from Americans seeking jobs in the Soviet Union.[97] In Germany the unemployment rate reached nearly 25% in 1932.[98]

In some towns and cities in the north east of England, unemployment reached as high as 70%; the national unemployment level peaked at more than 22% in 1932.[99] Unemployment in Canada reached 27% at the depth of the Depression in 1933.[100] In 1929, the U.S. unemployment rate averaged 3%.[101] In 1933, 25% of all American workers and 37% of all nonfarm workers were unemployed.[102]

In the U.S., the WPA (1935-43) was the largest make-work program. It hired men (and some women) off the relief roles ("dole") typically for unskilled labor.[103]

In the U.S., the WPA (1935-43) was the largest make-work program. It hired men (and some women) off the relief roles ("dole") typically for unskilled labor.[103]

In Cleveland, Ohio, the unemployment rate was 60%; in Toledo, Ohio, 80%.[104] There were two million homeless people migrating across the United States.[104] Over 3 million unemployed young men were taken out of the cities and placed into 2600+ work camps managed by the CCC.[105]

Unemployment in the United Kingdom fell later in the 1930s as the depression eased, and remained low (in six figures) after World War II.

Fredrick Mills found that in the U.S., 51% of the decline in work hours was due to the fall in production and 49% was from increased productivity.[106] By 1972 unemployment in the UK had crept back up above 1,000,000, and was even higher by the end of the decade, with inflation also being high. Although the monetarist economic policies of Margaret Thatcher's Conservative government saw inflation reduced after 1979, unemployment soared in the early 1980s, exceeding 3,000,000 – a level not seen for some 50 years – by 1982. This represented one in eight of the workforce, with unemployment exceeding 20% in some parts of the United Kingdom which had relied on the now-declining industries such as coal mining.[107]

However, this was a time of high unemployment in all major industrialised nations. By the spring of 1983, unemployment in the United Kingdom had risen by 6% in the previous 12 months; compared to 10% in Japan, 23% in the United States of America and 34% in West Germany (seven years before reunification).[108]

Unemployment in the United Kingdom remained above 3,000,000 until the spring of 1987, by which time the economy was enjoying a boom.[107] By the end of 1989, unemployment had fallen to 1,600,000. However, inflation had reached 7.8% and the following year it reached a nine-year high of 9.5%; leading to increased interest rates.[109]

Another recession began during 1990 and lasted until 1992. Unemployment began to increase and by the end of 1992 nearly 3,000,000 in the United Kingdom were unemployed. Then came a strong economic recovery.[107] With inflation down to 1.6% by 1993, unemployment then began to fall rapidly, standing at 1,800,000 by early 1997.[110]

21st century[edit]

The official unemployment rate in the 16 EU countries that use the euro rose to 10% in December 2009 as a result of another recession.[111] Latvia had the highest unemployment rate in EU at 22.3% for November 2009.[112] Europe's young workers have been especially hard hit.[113] In November 2009, the unemployment rate in the EU27 for those aged 15–24 was 18.3%. For those under 25, the unemployment rate in Spain was 43.8%.[114] Unemployment has risen in two-thirds of European countries since 2010.[115]

Into the 21st century, unemployment in the United Kingdom remained low and the economy remaining strong, while at this time several other European economies – namely, France and Germany (reunified a decade earlier) – experienced a minor recession and a substantial rise in unemployment.[116]

In 2008, when the recession brought on another increase in the United Kingdom, after 15 years of economic growth and no major rises in unemployment.[117] Early in 2009, unemployment passed the 2,000,000 mark, by which time economists were predicting it would soon reach 3,000,000.[118] However, the end of the recession was declared in January 2010[119] and unemployment peaked at nearly 2,700,000 in 2011,[120] appearing to ease fears of unemployment reaching 3,000,000.[121] The unemployment rate of Britain's young black people was 47.4% in 2011.[122]

A flood of inexpensive consumer goods from China has recently encountered criticism from Europe, the United States and some African countries.[123] As of 26 April 2005 Asia Times article notes that, "In regional giant South Africa, some 300,000 textile workers have lost their jobs in the past two years due to the influx of Chinese goods".[124] The increasing U.S. trade deficit with China has cost 2.4 million American jobs between 2001 and 2008, according to a study by the Economic Policy Institute (EPI).[125] From 2000 to 2007, the United States had lost a total of 3.2 million manufacturing jobs.[126]

About 25 million people in the world's 30 richest countries will have lost their jobs between the end of 2007 and the end of 2010 as the economic downturn pushes most countries into recession.[127] In April 2010, the U.S. unemployment rate was 9.9%, but the government's broader U-6 unemployment rate was 17.1%.[128] There are six unemployed people, on average, for each available job.[129] In April 2012, the unemployment rate was 4.6% in Japan.[130] In a 2012 news story, the Financial Post reported, "Nearly 75 million youth are unemployed around the world, an increase of more than 4 million since 2007. In the European Union, where a debt crisis followed the financial crisis, the youth unemployment rate rose to 18% last year from 12.5% in 2007, the ILO report shows."[131]